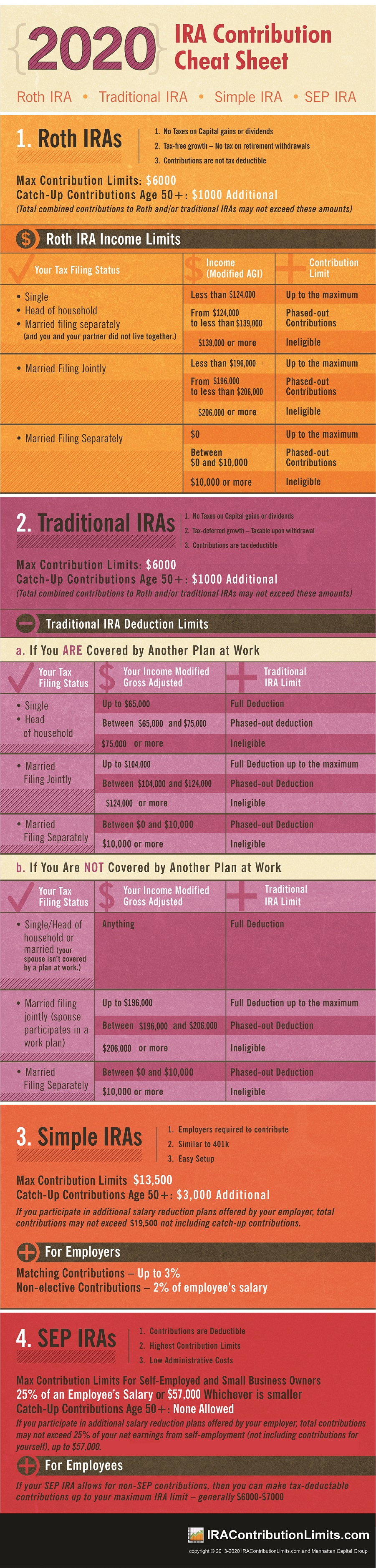

For 2020, the IRS changed many of the IRA limits allowed for every type of account. Keep track of all the tax, income and contribution limits with this handy chart below.

For complete IRA information see:

- 2020 Traditional IRA Rules – Covers all 2020 Traditional IRA Regulations

- 2020 Roth IRA Limits – Roth IRA rules have changed this year.

- SEP Contribution Limits – Up to date information on 2020 SEP IRA Contributions

- Simple IRA Rules – Complete Guide to Simple IRAs

The good news is that limits are rising across the board for all types of individual retirement accounts. This includes both Roth and Traditional IRAs, as well as Simple and SEP plans. Don’t forget your contribution deadlines.

2020 IRA Contribution Cheat Sheet for Roth, SEP, Simple and Traditional Retirement Accounts

Embed This Image On Your Site (copy code below):

2020 Plain Text Version

Jump to: Roth IRA – Traditional IRA – Simple IRA – SEP IRA

I. Roth IRAs

1. No Taxes on Capital gains or dividends

2. Tax-free growth – No tax on retirement withdrawals

3. Contributions are not tax deductable

Catch-Up Contributions Age 50+: $1000 Additional

Total combined contributions to Roth and/or traditional IRAs may not exceed these amounts.

Roth IRA Income Limits

Use this 2020 IRA contribution limits chart to find your maximum contribution based on income (AGI).

| Your Tax Filing Status | Income (Modified AGI) |

Contribution Limit |

|---|---|---|

|

Single, head of household, or married filing separately and you and your partner did not live together. |

Up to $124,000 |

Up to the maximum. |

|

From $124,000 to less than $139,000 |

Phased-out Contributions |

|

|

$139,000 or more |

Ineligible |

|

|

Married filing jointly |

Less than $196,000 |

Up to the maximum. |

|

From $196,000 to less than $206,000 |

Phased-out Contributions |

|

|

$206,000 or more |

Ineligible |

|

|

Married filing separately and you lived with your partner at least some of the year |

$0 |

Up to the maximum. |

|

Between $0 and $10,000 |

Phased-out Contributions |

|

|

Above $10,000 |

Ineligible |

For more information see Roth IRA Limits.

II. Traditional IRAs

1. No Taxes on Capital gains or dividends

2. Tax-deferred growth – Gains taxable upon withdrawal

3. Contributions are tax deductible

Catch-Up Contributions Age 50+: $1000 Additional

Total combined contributions to Roth and/or traditional IRAs may not exceed these amounts.

Traditional IRA Deduction Limits

Use the following 2020 IRA deduction chart to determine your maximum deduction based on income.

| You are Covered by Another Plan at Work | You Are Not Covered by Another Plan at Work | |||

|---|---|---|---|---|

| Tax Filing Status | Your Income Modified Gross Adjusted |

2020 Traditional IRA Limit | Your Income Modified Gross Adjusted |

2020 Traditional IRA Limit |

|

Single or head of household |

$65,000 or less |

Full Deduction |

Anything |

Full Deduction! |

|

More than $65,000 and less than $75,000 |

Phased-out deduction |

|||

|

$75,000 or more |

Ineligible |

|||

|

Married filing jointly |

$104,000 or less |

Full Deduction up to the maximum. |

$196,000 or less |

Full Deduction up to the maximum. |

|

More than $104,000 to less than $124,000 |

Phased-out Deduction |

More than $196,000 to less than $206,000 |

Phased-out Deduction |

|

|

$124,000 or more |

Ineligible |

$206,000 or more |

Ineligible |

|

|

Married filing separately |

Less than $10,000 |

Phased-out Deduction |

Between $0 and $10,000 |

Phased-out Deduction |

|

$10,000 or more |

Ineligible |

Above $10,000 |

Ineligible |

|

For more information visit Traditional IRA Regulations.

III. Simple IRAs

1. Employers required to contribute

2. Similar to 401k

3. Easy Setup

Catch-Up Contributions Age 50+: $3000 Additional

If you participate in additional salary reduction plans offered by your employer, total contributions may not exceed $19,500 not including catch-up contributions.

For Employers

Matching Contributions – Up to 3%

Non-elective Contributions – 2% of employee’s salary

For more information visit the Simple IRA Rules.

IV. SEP IRAs

1. Contributions are Deductible

2. Highest Contribution Limits

3. Low Administrative Costs

Max Contribution Limits

- 25% of an Employee’s Salary

or - $57,000

Whichever is smaller

Catch-Up Contributions: None Allowed

If you participate in additional salary reduction plans offered by your employer, total contributions may not exceed 25% of your net earnings from self-employment (not including contributions for yourself), up to $57,000.

For Employees

If your SEP IRA allows for non-SEP contributions, then you can make tax-deductible contributions up to your maximum IRA limit generally $6,000-7,000.

Embed This Image On Your Site (copy code below):